Articles

Connect the Venmo account to help you a huge number of apps and you will other sites and you will quickly here are some with your Venmo balance3 or a linked payment approach. Sure, more often than not, you need a connection to the internet, both thru Wi-Fi or a mobile research network, to accept cards money in your mobile phone. Mobile payments not just remove checkout queues, but they and enable you to undertake contactless card payments around your shop otherwise whilst you’re on the run.

To send dollars to help you somebody for pickup, we’ll you desire a reputation and you will target. With respect to the purchase, a P2P software will most likely not get paid of a bank checking account immediately—it might take one to a few business days. If the lender transforms on the exchange, a poor balance will get display screen in the P2P software.

Could you pay bills having a credit card?

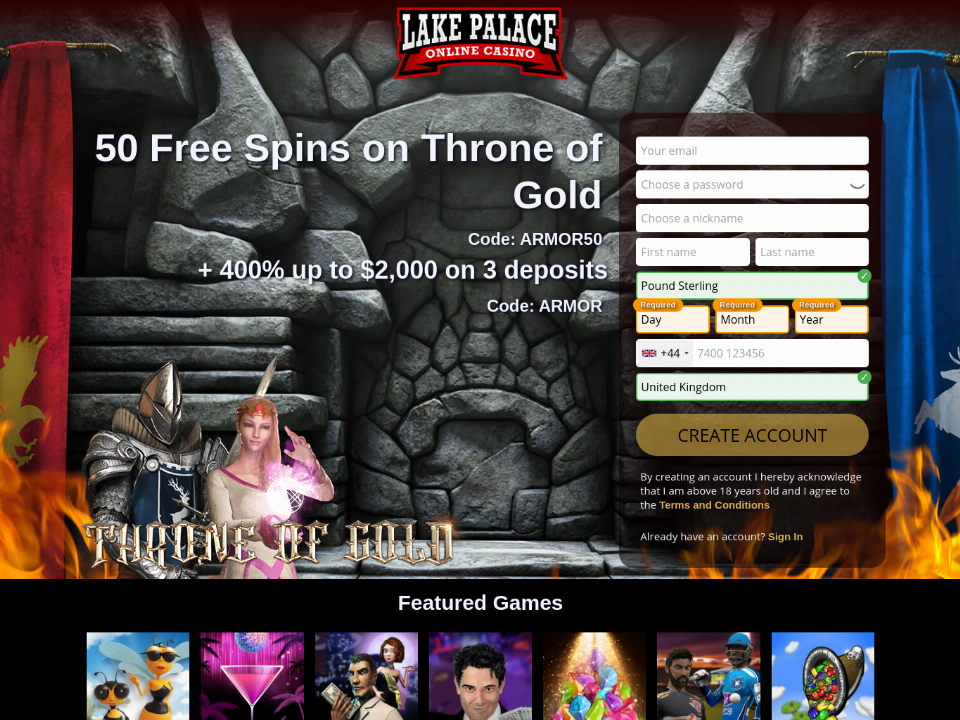

You’ll find all the free revolves no-deposit mobile confirmation Uk casinos here. If you are cellular-specific bonuses is actually shorter, they supply extra well worth for these to experience for the cell phones otherwise tablets. An educated bet for United kingdom participants is to look for harbors during the mobile put gambling enterprises offering a knowledgeable RTP’s. You could potentially read the full list of such video game within our better RTP harbors guide.

Having fun with a phone when deciding to take costs at the cafe eliminates the dependence on large, costly, and frequently unreliable bistro POS equipment. Host may take sales and you will procedure repayments in the exact same device, groups can easily separated payments, and you can purchase charge are often lower than traditional cafe POS systems. Once you’lso are lay-up, everything you’ll want to do is open their cellular phone and you may hold it near a suitable viewer to invest.

Set up percentage notice

- For the step 1 give, if you’re also essentially fairly clumsy together with your cellular telephone, you ought to probably think optimizing for the best cellular telephone insurance.

- U.S. Lender features instructions on exactly how to make use of your issues for traveling, and therefore’s how to make use of your issues since the an excellent cardholder.

- An advantage—even when a small you to for most people—is that when you’re with other people they may not be able to give exactly what cards you may have.

- To pay with an iphone 3gs and you will Deal with ID, double-click on the top button and you may look at the monitor to verify your name.

- NFC is a variety of broadcast-volume personality (RFID) tech, and therefore uses electromagnetic fields to identify close things and you can transmitted study.

Merchants have to have the right resources to just accept cellular repayments. Hence, it’s a good idea to carry some money or cards inside circumstances your find it. To buy a product or service during the a shop, you’ll need to accessibility their digital handbag making use of your biometrics otherwise tool passcode.

To set up your commission actions, you need to go into the Fitbit app on your own cellular telephone, faucet your avatar (better correct), after which tap the computer that you like to prepare. Discover Wallet and you will configure your percentage actions, and you may include a great PIN password to protect her or him. And you perform you want a great tracker or smartwatch to expend, since the Fitbit Pay won’t works directly from their cellular telephone. There are a few other configurations to evaluate, for example in case your cell phone has NFC switched on (it probably can get).

To pay along with your cellular phone, your usually need to take an electronic wallet or percentage app that’s associated with a cards otherwise family savings. After you’ve establish their fee means, you merely keep the cell phone around the percentage critical, check a QR code, or faucet to expend to complete the transaction. After you’lso casino guts review are create to make use of your mobile device because the an installment approach, whatever you’ll want to do are open their cellular phone, and you may wait around the seller’s commission terminal otherwise credit viewer. If you always leave the house carrying the cellular telephone, but never love holding your purse, this article to help you spending that have a card otherwise debit cards and you can your smart phone is for you. NFC cellular payments offer people more ways to invest which help business owners improve payment process more efficient and simpler. Since the today’s technology, NFC payments will be found in more towns, letting users dump their real notes in support of digital purses and you can contactless cell phone payments.

![]()

Anyone—team incorporated—have access to checkout tables and steal money you’ve taken from users. For individuals who’ve got a long waiting line out of consumers waiting to pick their things, the worst thing you want should be to cause them to become wait. More day they’lso are in-line, more day they should second-guess their get. So far, the new percentage is known as profitable, and you will provide the customer which have an acknowledgment otherwise confirmation of their purchase. Take your brand on the move and take on money, manage list and you can earnings, market every-where your web visitors is actually—farmer’s places, pop-up events and meetups, interest fairs, and you can anywhere in ranging from.

Because the contactless costs be much more extensively used, you might find you to electronic wallets allows you to abandon your own actual purse. From the space your own percentage steps or other extremely important notes on your own cellular phone, your eliminate the need to hold the majority of your papers and you may plastic material. Cellular costs can be used inside an equal-to-peer context or perhaps to shell out during the a stone-and-mortar organization. Within the a fellow-to-peer mobile commission, you possibly can make a digital transfer through your lender, say, to pay back a friend for supper or even to shell out somebody to your Craigslist to possess a bit of furniture. To possess mobile money at the a stone-and-mortar company, you can utilize an app on your mobile device — as opposed to bucks or a cards — to cover specific merchandise or features in the checkout restrict.

With cell phones fundamentally a necessity to own everyday routine, odds are you’re also spending a monthly cell phone statement. Regardless if you are playing with a keen iPhone1, Android2, or smartwatch, starting tap-to-spend is not difficult. And, it gives a good contactless way to shell out without any additional charge. However, it is wise to speak to your lender or card issuer so you can make sure that they won’t create charge. The only-date NFC code has hackers from having your credit guidance. And, since you wear’t touch one thing, it’s a less dangerous selection for your wellbeing.

Whether or not your’lso are to shop for coffee at the regional café or shopping on the internet, making use of your mobile phone to pay will likely be simpler and productive. Although not, as with any financial transaction, it’s important to always’lso are performing this properly. This article often walk you through the basics of smartphone costs and the ways to make use of them efficiently.

Ventra Cards on the new iphone 4 and you will Apple Watch

To possess cellular purchases money was repaid in order to individual’s mWallet account vendor to have credit to account tied to receiver’s cellular matter. Extra third-team costs will get apply, along with Sms and you will account more-limit and cash-away charge. Rewards from your Apple Credit is going to be put in the Apple Spend account, and you may make use of the equilibrium to send money to help you anybody else or to generate repayments during the a store. For those who wear’t have enough money loaded on the application, but not, you won’t be able to build your pick. To use the new Apple Shell out app to own repayments, money have to be placed into your bank account, which requires the more action out of placing currency “on” the new application before you use it.

That have fee suggestions kept on your cellular telephone, this may cause people fraudulently accessing the accounts. For those who remove your cellular phone or if it’s taken, you’ll need to monitor your accounts and stay prepared to terminate cards kept in their electronic handbag. When you are which are a nice making price, it takes playing with Kroger Spend, and similar standards pertain to the Find n’ Save/Metro Field Bank card and you will Ralphs Credit card. According to SquareUp, mobile purse money become more secure than conventional charge card repayments.

You can also encourage people so you can key in the new number on the the keypads to avoid eavesdroppers of taking its advice. Sure, really mobile fee applications have has that allow you to tune conversion process record, making it simpler to keep track of your own business’ overall performance. Sure, cellular commission options fool around with encryption so that the security from credit deals. Yet not, as the a vendor, be sure to make sure you keep the device secure and you can comply with the brand new Percentage Card Globe Investigation Security Requirements (PCI DSS).